Table of Contents

ToggleKey Points

- Before choosing a residential aged care facility for your loved one, you should consider the upfront cost as well as ongoing costs.

- The cost of living in a facility can be high, depending on the size of the room, services offered and more.

- Accessing support services does not always mean you have to move out of your home.

- There is no distinction between low care and high care so the accommodation payment rules apply to all subsidised residential care places.

- Once you have accepted a place and signed the Resident Agreement you will have 28 days to decide which fee option to pay.

- Depending on your income and assets you may be asked to pay a means-tested daily care fee.

- Your available options may depend on your family arrangements and your health requirements.

Before choosing a residential aged care facility for your loved one, you should consider the upfront cost as well as ongoing costs. The cost of living in a facility can be high, depending on the size of the room, services offered and more. If you’re looking for ways to reduce costs when contemplating residential aged care fees, look at ways such as home care packages and discounts.

Accessing support services does not always mean you have to move out of your home. Help to stay in your home longer is available through home care services but these services do not work for everyone, especially those living alone or with high aged care needs.

So for some people, a move into residential aged care may be a better alternative. Careful planning ahead of time can make all the difference and remove a lot of the stress at the time when a decision needs to be made.

What Does Aged Care Cost?

The residential aged care fees or the cost to care for someone in a residential service can be as high as $256.44 per day (around $93,600 per year) but thankfully these costs are heavily subsidised by the government.

The Federal Government spends over $18 billion a year on aged care. This is in addition to costs incurred by care providers for building and maintaining the facilities and the residential aged care fees paid by residents.

With the percentage of Australia’s population over age 85 set to triple over the next thirty years the pressure on finances is increasing and the rules for fees changed on 1 July 2014.

What are the rules for residential aged care fees?

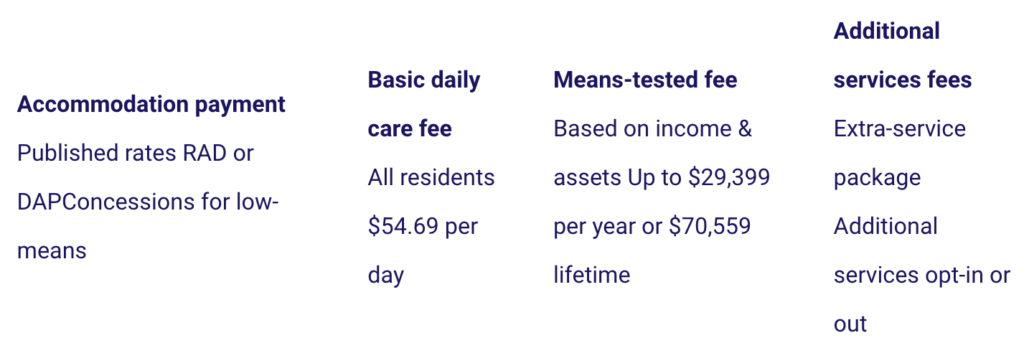

The range of residential aged care fees and calculation methods may appear complex but fees can be divided into four categories. The diagram below provides a quick overview of the fee structure for residential aged care.

The important things to know about the current rules are:

- There is no distinction between low care and high care so the accommodation payment rules apply to all subsidised residential care places.

- The accommodation payment is quoted as a lump sum (called a refundable accommodation deposit – RAD) and an equivalent daily fee (called the daily accommodation payment – DAP). You can check the rates at www.myagedcare.gov.au/find-a-provider

- Once you have accepted a place and signed the Resident Agreement you will have 28 days to decide which fee option to pay.

- If you pay the lump sum RAD it is fully refundable when you leave care and repayment is guaranteed by the Federal Government provided you have paid the RAD to an approved service provider.

- Depending on your income and assets you may be asked to pay a means-tested daily care fee. This increases how much you pay and reduces how much the government pays for your care. This fee is capped over a year and over your lifetime (both indexed).

- If you moved into care before 1 July 2014, the rules are different. The previous rules continue to apply unless you move from one service provider to another (without a gap of 28 days or more) and choose to have the new rules apply.

Things to Consider

Financial aspects are only one consideration when preparing for your care years. It is more important to find the right care service at the right time.

Your available options may depend on your family arrangements and your health requirements. But if your finances are carefully planned, you will have more choices and greater control over where and how you live and receive care.

Advice from an adviser who is experienced in aged care is key. Advice can help you see the bigger picture and take into consideration your family needs and estate planning considerations as well as strategies to generate sufficient cash flow, including access to government benefits and concessions.

If you think your plans need to be reviewed or you would like further information on aspects of aged care, contact us to make an appointment today.

You May Also Like

Get in Touch

Got a question…? Looking for help…? Message us!