Table of Contents

ToggleKey Points

- The age pension is a government-funded income supplement aimed to help retirees in Australia.

- Eligibility for an age pension and liability to pay aged care fees, are both impacted by your assets and income.

- Your home is not considered an asset for calculating your pension or payment, but it does have an impact on how your age pension or payment is assessed under the assets test.

- If you move out of your home, the former home usually becomes an investment property and is fully assessable at market value.

- Moving to a retirement village brings its own set of rules. This is considered to be a move to a new home rather than to access care.

- Money used to pay the accommodation costs for residential aged care, is an exempt asset.

It is the great Australian dream to own your own home. But how does your home affect your age pension or the aged care fees you can be asked to pay?

Who Can Get Age Pension

The age pension is a government-funded income supplement aimed to help retirees in Australia. Eligibility for an age pension and liability to pay aged care fees, are both impacted by your assets and income. This includes an assessment of where you live and your ownership status.

Your home is not considered an asset for calculating your pension or payment, but it does have an impact on how your age pension or payment is assessed under the assets test.

The Centrelink (or Veterans’ Affairs) assets test starts by identifying you as either a homeowner or a non-homeowner. A higher threshold applies to non-homeowners but homeowners receive an exemption for the home.

If you are a homeowner, your asset value limit is lower than if you don’t own your home. The asset value limit refers to the maximum amount of assets a person can have before their age pension or payment is reduced from the maximum rate under the assets test.

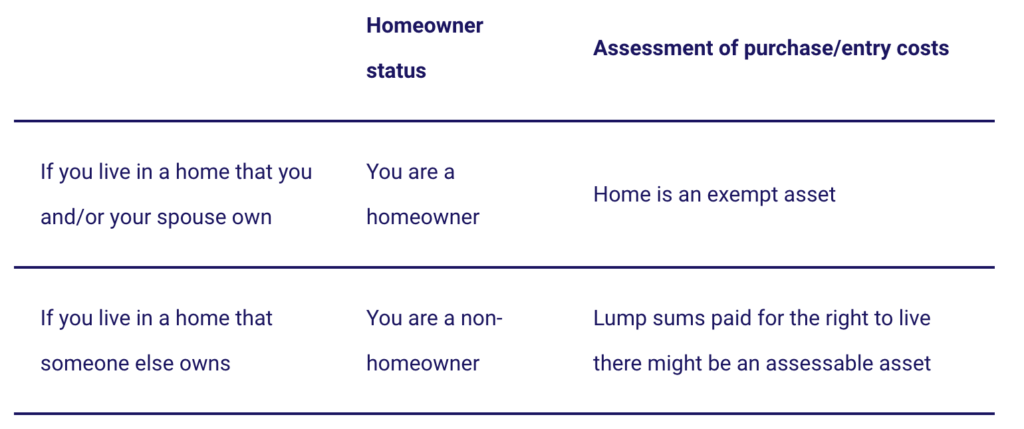

At first glance it may seem simple to decide whether you are a homeowner or not, but it is not always that easy. The basic premise is:

But if only it really were that simple. Arrangements may be more complex and variations may apply for certain situations before you become eligible for age pension. In some cases, you may be considered a homeowner even if you don’t own the home – for example under certain rules for aged care and retirement villages.

What is the exempt amount?

If you are classified as a homeowner, the building you live in will be an exempt asset, as well as up to two hectares of land (if that land is held for personal use). Farmers and people on rural properties may receive approval to exempt a greater parcel of land if they meet requirements for the 20-year extended land-use test rule.

What if you move out?

If you move out of your home, the former home usually becomes an investment property and is fully assessable at market value. Some specific exemptions include:

- Move to access care – you may continue to be a homeowner with the home exempt for up to two years.

- Temporary move – in other cases, if the move is only temporary, you may be allowed a 12-month continuation of your homeowner status.

Moving to a retirement village brings its own set of rules. This is considered to be a move to a new home rather than to access care. Whether you are a homeowner or not, will depend on how much you paid as your entry contribution and the former home is assessed as an investment property if still owned.

If you sell your home, the sale proceeds are assessed depending on how they are used or invested unless you intend to use the sale proceeds to purchase or build a new home. In this case, you can continue to be a homeowner, with a continuing assets test exemption, for the first 12 months. Money used to pay the accommodation costs for residential aged care, is an exempt asset.

talk to Us

Buying a home or moving out of your home are major life decisions, and can involve significant amounts of money. Access to advice can help to ensure that you make a fully informed decision and understand the impacts on your age pension or aged care fees – mistakes are too costly to make. As Accredited Aged Care ProfessionalsTM, we have the expertise to help you understand the full implications. Call us on 1300 550 940 to make an appointment.

You May Also Like

Get in Touch

Got a question…? Looking for help…? Message us!